3 Market Stats You Haven't Heard

What's in the Senate's Home Inspection Amendment? | Market Updates From Across the Borders | News Nuggets

Data Points Worth Watching

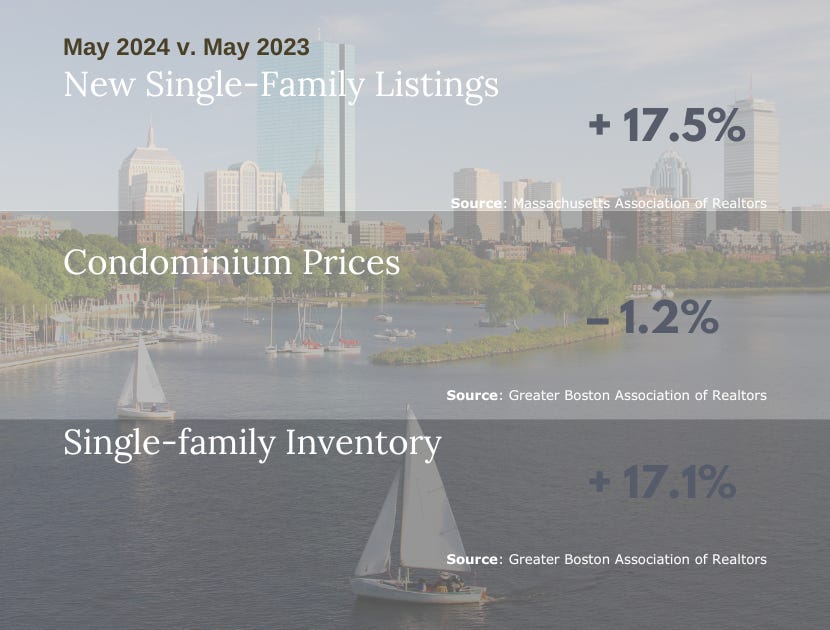

The local media often covers the Massachusetts monthly real estate basics, such as May 2024’s closed sales (up 6.9%) and median prices (up 7.3% to $660,000) year over year. There are also passing mentions of scarce inventory, but other data points are worth watching.

According to the Massachusetts Association of Realtors (MAR) and the Greater Boston Association of Realtors (GBAR), the following is some Boston area real estate data you probably haven't read.

1. New Listings: Single-family inventory has drifted downward over the past decade. Scarce inventory is partly responsible for limited sales over the past 12 months. The single-family and condominium inventory situation may see some improvement shortly.

MAR stats indicate that new single-family listings have increased in four of the last five months (January-May) year-over-year. New listings are up double digits in three of the past four months: February +21.3%; March -12.3%; April +21.1%; and May +17.5%. January saw a 3.9 percent increase.

For condos, new listings have also increased in four of the last five months on a year-over-year basis: January +11%; February +14.9 %; March –15.4%; April +17.1 %; and May +5.8%.

2. Greater Boston Condo Prices: You might have heard the GBAR reported the median price of a single-family home in the 64 cities and towns in its coverage area in and around Boston rose nearly 6 percent in May to a record $950,500. You might not have heard Greater Boston condominium prices slipped just over 1 percent in May compared to May 2023. Median condo prices are up about 2 percent from January through May year over year.

3. Inventory Rising: Everyone understands why home prices have continued to rise. It's primarily a supply-and-demand story; however, the Boston area's single-family supply grew double digits in May and slightly in April. GBAR reported 1,607 active listings in May, up 17 percent from May 2023. As recently as March 2024, there were less than 1,000 available houses.

It's still a far cry from the 3,408 single-family homes available in Greater Boston in May 2019. The next few months may indicate a trend or a blip.

Active condominium units decreased nearly 3 percent to 1,826 in May year over year but were up almost 3 percent compared to April 2024. There were 300 units more available in May than in March 2024.

Senate's Home Inspection Amendment Allows Few Exceptions

In the last issue, Real Boston reported that Massachusetts state senators unanimously (39-0) adopted Millbury Senator Michael Moore's amendment to a state housing bill prohibiting "most offers" conditioned on the home buyer waiving or limiting their right to a home inspection.

Senator Moore told Real Boston that home buyers should know what they are purchasing before making one of the most significant investments in their lives.

"This amendment will curb the practice of making offers that waive the right to a home inspection, something that's become increasingly common in this ultra-competitive real estate market," Senator Moore said. "Buyers must not feel obligated to waive inspections, risking their most important investment, in order to find their forever home. In a Commonwealth where we have long taken a strong approach to consumer protections, this is an obvious step to protect families from financial ruin due to costly undisclosed repairs."

The amendment language is straightforward and doesn't allow sellers and agents to skirt the prohibition. The following is the full text of the amendment:

Section 101. The executive office of housing and livable communities shall promulgate regulations to ensure that no seller of a residential structure or a residential condominium unit, or agent thereof, shall: (i) condition the acceptance of an offer to purchase on the prospective purchaser's agreement to waive, limit, restrict or otherwise forego any prospective purchaser's right to have said structure or unit inspected, except when the sale of the structure or unit is to occur at an auction conducted by an auctioneer licensed under chapter 100; or (ii) accept an offer to purchase from any prospective purchaser, or agent thereof, who, in advance of the seller's acceptance of said offer, informs the seller, either directly or indirectly, that the prospective purchaser intends to waive, in whole or in part, the prospective purchaser's right to inspection; provided, however, that the seller may accept such an offer without violating this section when the prospective purchaser is: (A) the spouse, sibling, child,parent, grandparent, grandchild, great-grandchild or great-grandparent of the seller; or (B) the former spouse of the seller and the sale of the structure or unit is being made pursuant to a judgment or order under chapter 208; provided further, that other limited exceptions may be provided for by regulation."

Market Updates From Across the Borders

The New Hampshire Association of Realtors reported that single-family home sales increased statewide 7 percent to 1,036 in May from 967 in May 2024. The median house price jumped 13 percent to $525,000. Some relief may be on the way for home buyers. Months of supply (+43%), new listings (+17%), and homes for sale (+28%) increased in May year over year.

Granite State condominium sales rose 21 percent, and the median condo price rose 13 percent to $449,900. Condominium inventory, months of supply, and new listings increased.

The Rhode Island State-Wide Multiple Listing Service reported single-family home sales dipped more than 3 percent percent to 644 in May 2024 from 668 in May 2023. Home buyers bought 813 houses in May 2022. The median house price increased nearly 8 percent to $460,000 from $427,250 in May 2023 and $419,000 in May 2022.

The Ocean State condominium market went differently, with sales rising and prices falling. In May 2024, Home buyers purchased 169 units, a 3 percent increase from 164 in May 2023. Home buyers scooped up 210 condos in May 2022. May's $350,000 median condo price was 11 percent less than May 2022's $392,500 but higher than May 2022's $328,000.

News Nuggets

Four Wealthy Massachusetts Suburbs: Wellesley, Winchester, Lexington, and Needham made GOBankingRates's list of the 50 wealthiest suburbs in the United States. GOBankingRates looked at cities with 5,000 or more households and ranked the top 50 cities with the highest average household income. Zillow data determined "typical" home value. The wealthiest U.S. suburb was Scarsdale, New York, where the average household income is $568,942.

Norfolk County's Town of Wellesley ranked highest in Massachusetts at No. 11. Wellesley's average household income is $367,801, and the typical home value is about $1.97 million. In Middlesex County, Winchester ranked 31st, with an average household income of $283,632 and a home value of roughly $1.6 million. Middlesex County's Lexington finished No. 35 with an average household income of $281,187 and a home value of about $1.6 million. Needham, in Norfolk County, ranked 42 on the list, with an average household income of $267,951 and a home value of around $1.5 million.

Southie's 776 Summer Project: Hilco Redevelopment Partners (HRP) claims it "will turn the grand and storied space of the former Boston Edison power plant into a vibrant community destination." The Boston Globe reports that HRP will construct 636 housing units.

"We plan to honor the legacy of the former Boston Edison Power Plant ...," said EVP of Mixed-Use Development Melissa Schrock on 776Summer.com. "Anchored by the adaptive reuse of the magnificent century-old turbine halls, 776 Summer will offer the community direct access to the waterfront as well as new open spaces and gathering places ..."

Suburban Growth Outpaces Urban Expansion: A recent report by StorageCafe indicates that the current housing market, with soaring prices and curbed inventories, is one of the primary factors driving people out of cities and into the suburbs and exurbs. The South leads in housing expansion, with Texas featuring seven suburbs among the top 20 fastest-growing housing markets and Florida having five.